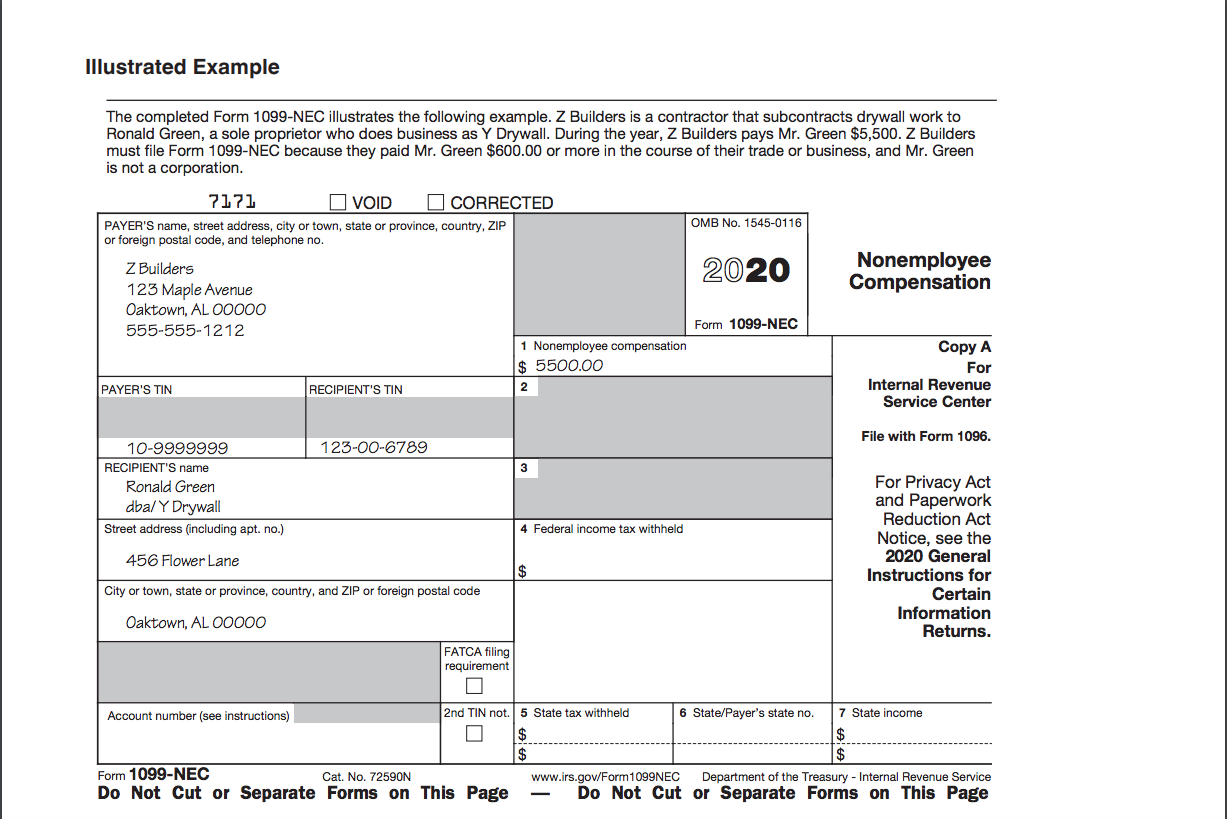

Last used in 1982, Form 1099-NEC made a comeback in 2020 for reporting nonemployee compensation (NEC) to independent contractors. Previously, “1099 wages” were reported in box 7 on the 1099-MISC.

The IRS reintroduced Form 1099-NEC to accommodate the firm filing deadline of January 31st for reporting nonemployee compensation and certain other payments. This NEC deadline was set by the PATH Act passed in 2015, which also eliminated the automatic 30-day extension for reporting NEC. Payments reported on other 1099 forms, such as the 1099-MISC, are due February 28th if filed on paper or March 31st if filed electronically; you may request an extension for filing IRS and recipient copies via Form 8809.

You need to file a 1099-NEC to report payments of $600 or more for the following business-related items:

- Services provided by individuals who are not your employees (e.g., independent contractors), including parts and materials

- Attorney fees (Note: gross proceeds to an attorney are still reported on Form 1099-MISC)

- Cash payments for fish (or other aquatic life)

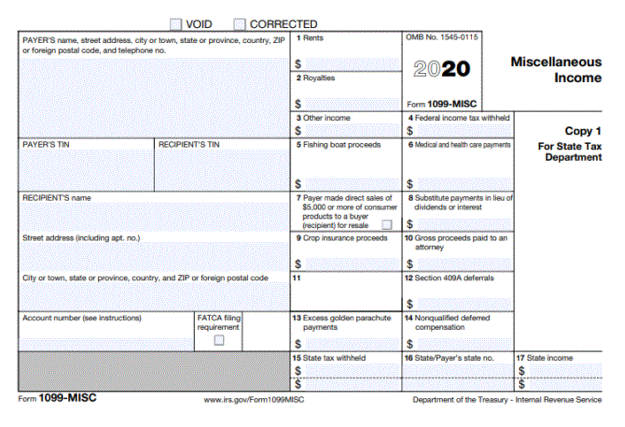

2020 Changes to Form 1099-MISC

Box Number Changes on the 2020 Form 1099-MISC:

- Box 7: Payer made direct sales of $5,000 or more (checkbox)

- Box 9: Crop insurance proceeds

- Box 10: Gross proceeds paid to an attorney (Note: report attorney fees of $600 on a 1099-NEC)

- Box 12: Section 409A deferrals

- Box 14: Non-qualified deferred compensation income

- Boxes 15, 16, and 17: State taxes withheld, state identification number, and amount of income earned in the state, respectively